Major themes of 2023, What’s Ahead for 2024 in...

The increasing prevalence of embedded finance is leading to greater consumer expectations...

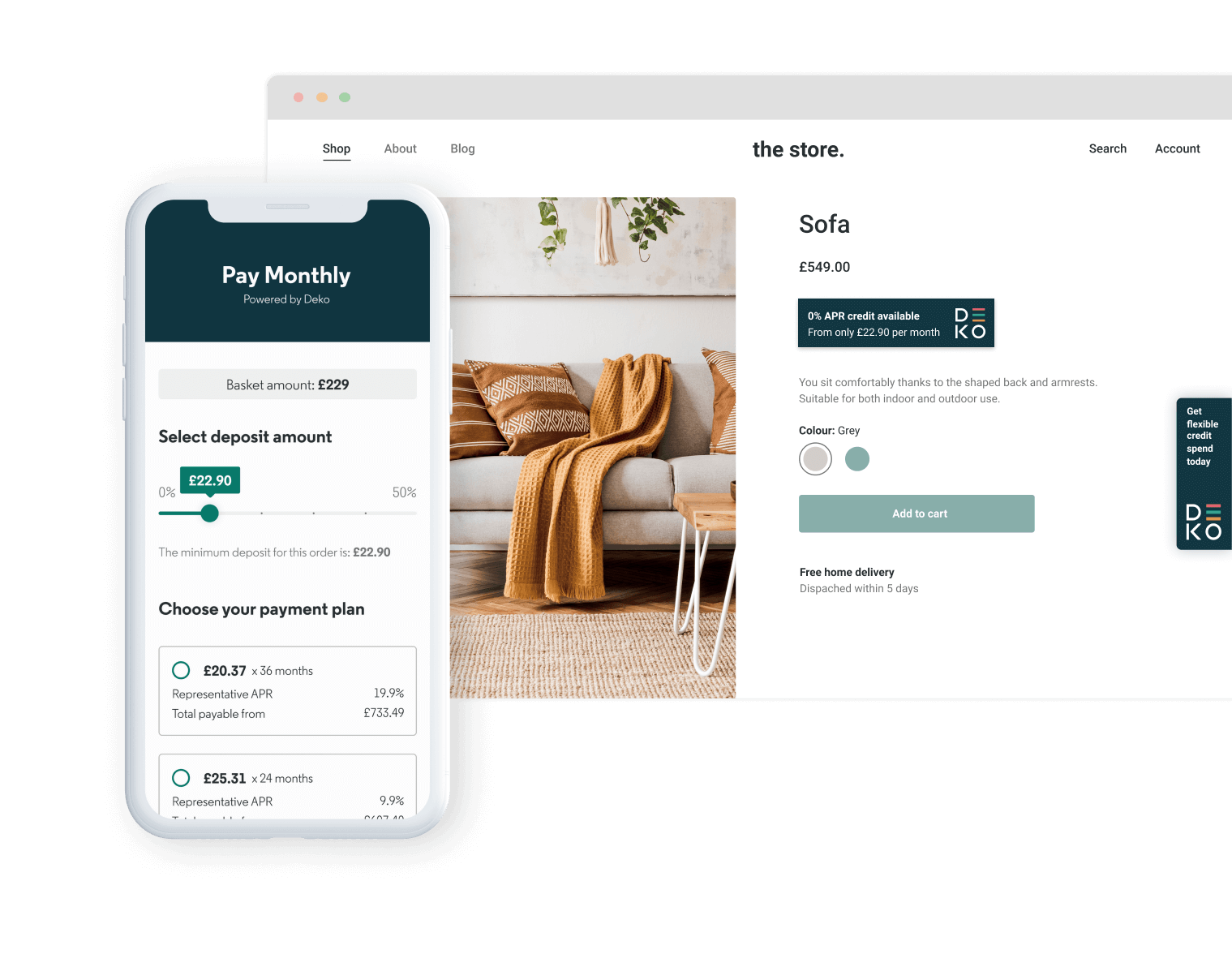

A single platform that unlocks the benefits of credit for every retailer and every basket. Our panel of lenders will say yes to more customers at checkout.

Flexible retail finance for all sectors at your fingertips.

A flexible monthly payment option that covers any basket size and allows customers to spread the cost over months or years.

A digital credit account that turns purchases into manageable monthly payments and makes repeat spending easy.

An interest-free payment solution that enables customers to split the cost of their purchase into 3 equal payments.

Drive up basket size, conversions and customer numbers with the only retail checkout finance solution tailored for your business. From buy now, pay later to instant credit eligibility checking, using Deko’s multi-lender options secures higher acceptance rates for your customers.

Deko needs your information to send you the content you’re requesting. You can unsubscribe at any time. For more information visit our Privacy Policy.

The increasing prevalence of embedded finance is leading to greater consumer expectations...

A history of London Camera Exchange London Camera Exchange has a long history dating back...

eCommerce merchants operating on the Craft Commerce system will now be able to offer...

Deko© is a trading name of Pay4Later Limited, registered in England & Wales (company number 06447333). Authorised and regulated by the Financial Conduct Authority (number 728646). Deko is a credit broker, not a lender and does not charge you for credit broking services. Deko provides introductions to a carefully selected panel of lenders.